In Chapter 4 of the Ultimate Guide to Blockchain Marketing and Cryptocurrency, we’ll cover the value proposition of cryptocurrency, who’s using it, and why bitcoin is blowing up.

Cryptocurrencies are digital currencies that use blockchain as a base. They aren’t physical coins or cash, but are stored in a ‘digital wallet’. Think of them almost like a foreign currency. While it’s not governmentally regulated, it’s affected by supply/demand and world happenings, much like federal currencies.

Because cryptocurrencies are built on blockchain — a public ledger that verifies, holds, and displays all transactions in one place on a peer-to-peer network – they can operate in a decentralized manner, independent of major banks and other traditional financial institutions.

Blockchain technology plays a crucial part in bringing cryptocurrency tokens, or units of currency, into the world economy via a process called mining. Miners use powerful computers to solve algorithms on the crypto network, and when they successfully solve one, they get to add a transaction, or a ‘block’ to the blockchain.

Each algorithm that’s successfully solved helps verify a transaction, and in exchange for solving it, the user receives a token.

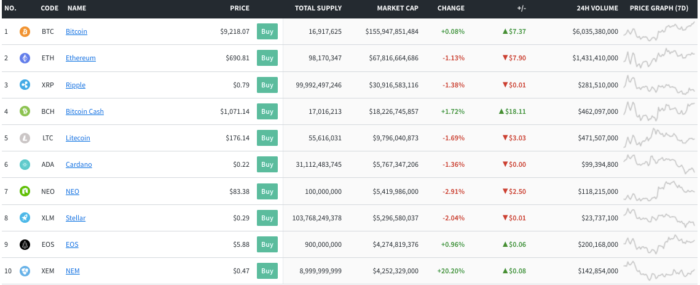

Bitcoin, the first cryptocurrency, hit the market in 2009 and paved the way for thousands of other cryptos in the years since, including Ethereum, Ripple, Litecoin, and many more.

The Rise of Cryptocurrency

A transformation in currency such as this one hasn’t been seen in years, if ever: in 2013, a single Bitcoin was worth about $7. Today? It’s worth close to $10K– a figure that is constantly changing.

Just imagine…if you’d bought a few Bitcoins in 2013, you’d be swimming in money now!

Banks and businesses alike are seeing the benefits of digital currency and the blockchain technology that supports it. Right now, there are about 10 million Bitcoin users around the world, with about 5 million using it as an investment vehicle. The other 5 million are actually using it for transactions.

And buying crypto really is as easy as buying clothes on Amazon. Coinbase, for example, is a popular interface to buy crypto with fiat (fiat = paper currency like dollars or euro).

The Value Proposition of Cryptocurrency

1. Borderline Anonymity on the Blockchain

Cryptocurrency transactions allow senders and recipients to engage in borderline anonymous transactions, or pseudonymity. These transactions can still be uncovered by law enforcement, but customers won’t have to provide their personal details to merchants. This means they’re more protected through blockchain transactions than online credit card transactions.

2. Peer-to-peer Purchasing with Cryptocurrency

Cryptocurrency and blockchain technology cut out the middleman in all sorts of ways.

For example, let’s take Google Display marketing. The biggest reason that website owners sign up to display Google ads on their site is because it’s not as convenient to transact with advertisers directly. It’s difficult for site owners to screen advertisers (to see who’s “legit” and who isn’t), and it’s not as easy for advertisers and site owners to reliably track clicks (to make sure that advertisers pay a fair rate).

But with the blockchain, things would unfold a bit differently. Website owners and advertisers would be able to make deals with each other directly because clicks and users are automatically validated.

Think of bank transactions in the same way.

If a bank’s online database was hacked, it would be totally reliant on backups and other technology to restore information. Consumers would have to wait until the backups were restored, and they’d have to deal with the consequences if there were any problems getting things up and running again.

With the blockchain, the bank’s platform would remain up and running smoothly even if hackers managed to compromise part of the system because the data isn’t stored on a central server. Cryptocurrency and blockchain technology allow for peer-to-peer transactions through a decentralized system, which prevent against hacks and other cybersecurity issues.

3. “Smart” Contracts Through Blockchain Technology

Another benefit of blockchain technology is “smart” contracts – or transactions where you can exchange shares, property, money, etc., in a way that doesn’t involve middlemen.

An easy way to think about smart contracts is by comparing it to a vending machine.

Normally, when you go to retrieve a document, or a “contract” of any kind – a driver’s license, a lease deal, etc. – you have to go through a process of signing contracts with whomever is involved in the transaction.

With the blockchain, these transactions can happen automatically with “built-in” verification systems. For example, you could drop bitcoin or ethereum into a vending machine and get a a driver’s license or a lease on a car right away.

A smart contract is a normal contract that can be coded into the blockchain. People involved in the contract can remain anonymous because they don’t have to provide personal details. The contract can “self-execute” according to the given guidelines, without the need for middlemen in the process.

Source: Blockgeeks

Businesses Are Embracing Cryptocurrency

Crypto transactions could eventually become the norm as the technology continues to gain traction among banks, businesses, and consumers alike. Companies large and small are accepting cryptocurrency. There are hundreds of thousands of businesses, online and brick-and-mortar, that accept digital currency from customers. In Japan, it is estimated that over 250,000 businesses accept Bitcoin.

In one example, CheapAir.com was the first online travel agency to accept Bitcoin, and within six months they processed approximately $15 million in Bitcoin transactions.

Now, from online travel to house cleaning services, more and more industries are adopting cryptocurrency. Examples include Microsoft, Sears, Subway, Home Depot, Tesla, Shopify, ReMax, andOverStock.com. All you need in order to accept bitcoins is a digital wallet and a ‘pay with Bitcoin’ button at the checkout.

Check out this list of specific businesses that currently accept Bitcoin.

Who’s Using Cryptocurrency?

Not surprisingly, younger generations are the first to adapt to cryptocurrency. According to a Fortune survey, 58% of Bitcoin investors are between 18 and 34.

Not surprisingly, younger generations are the first to adapt to cryptocurrency. According to a Fortune survey, 58% of Bitcoin investors are between 18 and 34.And a Forbes survey shows that Millennials:

- Are 10 times as likely as those ages 65+ to “strongly agree” that Bitcoin is a positive innovation in financial technology (20% vs. 2%).

- Believe in Bitcoin adoption: 42% of millennials believe it’s likely most people will use Bitcoin in the next 10 years, compared to 14% of those ages 65+.

- Prefer to own Bitcoin over traditional financial assets like stocks (27%), government bonds (30%), real estate (22%), and gold (19%).

The Inevitable Evolution of Payment Acceptance

Any shift in technology demands a response from businesses, and it’s especially true when it comes to the evolution of payment acceptance. And it’s been seen time and time again: when credit cards became the norm over paper money, when e-checks became favored over paper, and most recently when digital payment apps like PayPal and Google Wallet became popular.

“Businesses are looking for new lightweight, service-oriented ways to communicate with customers on mobile, and … it’s clear that mobile wallets will lead the next wave of mobile engagement.” ~Brett Caine, Urban Airship CEO and President