The upcoming recession is not just a time of economic downturn; it’s a massive buying opportunity for founders. If you’ve ever considered buying a small business, now might be the perfect time to act.

However, before you jump in, there are some crucial things you need to know.

In this post, I’ll share a couple of lessons I learned from buying small businesses so that you can avoid making the same mistakes I made.

Should You Buy a Failing Business?

Understanding the advantages and disadvantages is crucial when you’re trying to make an informed decision about acquiring a failing business. Let’s take a look at the pros and cons of buying a failing business.

Pros of buying a failing business:

- Lower Purchase Price: Failing businesses often come with a reduced price tag, making them more affordable to acquire.

- Negotiation Leverage: The urgency to sell can give you significant leverage in negotiations, potentially leading to favorable terms.

- Existing Infrastructure: Even if the business is failing, it likely has some level of infrastructure like equipment, technology, and perhaps even a customer base, which you won’t have to build from scratch.

- Skilled Workforce: If the business has a team in place, you may be able to retain skilled employees who are already familiar with the industry.

- Turnaround Potential: With the right strategy, resources, and execution, you could turn the business around and make it profitable, thereby increasing its value substantially.

- Intellectual Property: The failing business may have valuable patents, trademarks or copyrights that can be leveraged.

- Market Presence: Even a failing business has some level of brand recognition and market presence, which can be easier to improve upon than starting from zero.

Cons of buying a failing business:

- High Risk: The business is failing for a reason, and there’s a significant risk that you may not be able to turn it around.

- Hidden Liabilities: Failing businesses often have debts, legal issues or other hidden problems that you’ll inherit upon purchase.

- Reputational Damage: The business may have a tarnished reputation that could be hard to shake, affecting future profitability.

- Resource Intensive: Turning around a failing business often requires a significant investment of time, money and effort.

- Employee Morale: Low morale and productivity among existing staff can be challenging to improve and could affect the turnaround efforts.

- Market Decline: The business might be failing not due to its own faults but because it’s in a declining market or industry.

- Complexity in Valuation: Determining the fair value of a failing business can be complicated, increasing the risk of overpaying for it.

- Integration Challenges: If you’re merging the failing business with an existing one, cultural and operational integration can be complex and fraught with pitfalls.

Now that we’ve got that out of the way…

My first piece of advice is: Avoid businesses that require a turnaround.

While the idea of reviving a failing business may seem appealing, the reality is far more complex. A business with declining revenue and a dwindling client base is a risky investment. The effort required to bring a business like this back to its original value is often underestimated.

When considering an acquisition, you should focus on businesses that are already growing, have healthy margins and a strong track record. The allure of a “good deal” on a failing business can be tempting, but the risks often outweigh the rewards.

In order to get a failing business back to its original value, you have to gain by 100%.

I’m talking about the mathematical reality of recovering from a loss. If a business loses 50% of its value, it will need to gain 100% just to return to its original value.

Here’s a simple example to illustrate this point:

- Let’s say a business was originally valued at $100.

- If it loses 50% of its value, it will be worth $50.

- To get back to its original value of $100, it will need to gain $50.

- A $50 gain on a $50 value is a 100% increase.

So, even though the business lost 50% of its value, it needs to gain 100% to return to its original value. This concept is important for anyone considering buying a failing business, as it highlights the uphill battle required to restore the business to its former state.

My Biggest Mistake in Buying My Marketing Agency

I know a thing or two about growing a fledgling business.

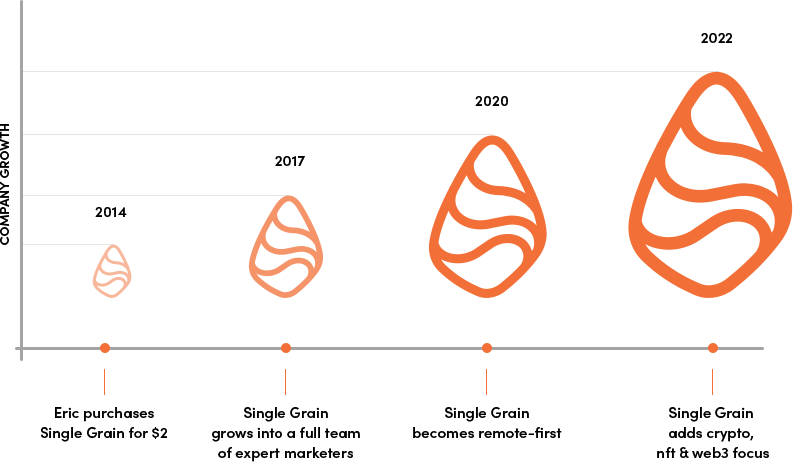

In 2014, I bought Single Grain, a failing SEO agency at the time (which I’ve since turned into a successful full-service digital marketing agency) for $2.00 (and, nope, that’s not a typo). Here’s a nifty little growth chart:

Prior to that, I had experience in growing an online education company when it was on the brink of bankruptcy. So I figured I knew what I was doing.

But one of the biggest mistakes I made (here’s another post about mistakes I made – and the lessons I learned that helped me become successful!) was not doing enough due diligence before I bought it, particularly on the people within the company. Realizing too late that the team was not the right fit was a costly error.

Being decisive about personnel is crucial. Delaying such decisions can harm the business in the long run. If your gut tells you someone is not a good fit, act on it.

If it’s not a hell yes, it’s a hell no.

Remember, the only person to blame if things go wrong is you. As the owner and the GM of your business, you’re responsible for putting the right squad together.

Due Diligence Checklist

Due diligence is a critical step in acquiring any business, but it becomes even more crucial when you’re considering buying a failing one.

Here’s a basic checklist to guide you through the due diligence process:

Financial Analysis:

✅ Financial Statements: Review the last 3-5 years of financial statements, including income statements, balance sheets, and cash flow statements.

✅ Debt and Liabilities: Examine all debts, loans, and other financial obligations.

✅ Revenue Streams: Analyze the sources of revenue and their sustainability.

✅ Expenses: Scrutinize all operating expenses, including rent, utilities, salaries, and vendor contracts.

✅ Tax Records: Review tax returns and any pending or past tax issues.

Legal Review:

✅ Contracts and Agreements: Examine all existing contracts, including with suppliers, customers, and employees.

✅ Intellectual Property: Inventory all intellectual property like patents, trademarks, and copyrights.

✅ Regulatory Compliance: Ensure the business is in compliance with all local, state, and federal laws and regulations.

✅ Litigation History: Check for any past, pending, or potential lawsuits.

Operational Assessment:

✅ Inventory: Evaluate the current inventory levels and their quality.

✅ Equipment and Assets: Inspect the condition of all physical assets like machinery, equipment, and real estate.

✅ Technology: Assess the state of the business’s technology, including software, databases, and cybersecurity measures.

✅ Employee Records: Review employee contracts, benefits, and morale. Conduct interviews if possible.

Market and Industry Analysis:

✅ Market Trends: Analyze the market trends and the business’s position within the market.

✅ Customer Analysis: Review customer demographics, satisfaction levels, and any customer concentration issues.

✅ Competitor Analysis: Evaluate the competitive landscape and how the failing business stacks up.

✅ Supplier Relationships: Assess the reliability and terms of supplier contracts.

Cultural and Strategic Fit:

✅ Company Culture: Evaluate how the company culture will fit with your existing or desired business culture.

✅ Strategic Alignment: Assess how the acquisition fits into your overall business strategy.

Due diligence is critical. If you’re not detail-oriented, surround yourself with experts who are. Lawyers, finance professionals and accountants can provide invaluable insights during the acquisition process.

Tips for Business Integration That You Should Know

Once the acquisition is complete, the real work begins: integration.

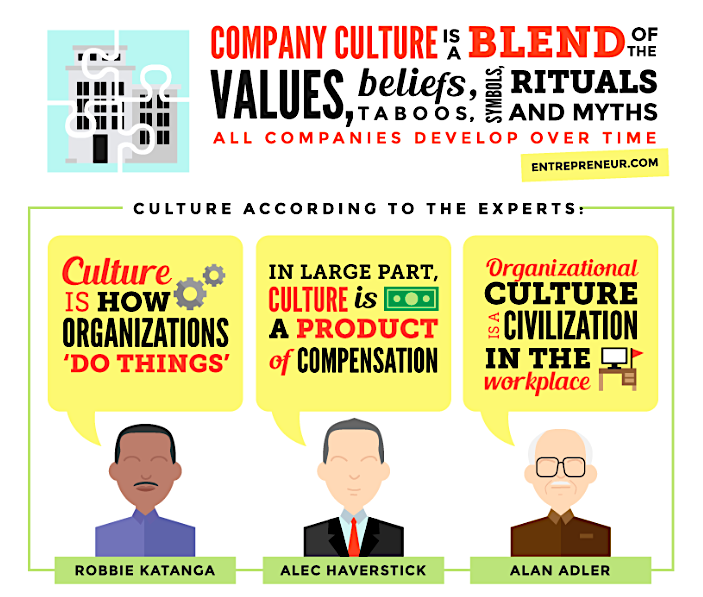

The process of acquiring a company is often seen as the pinnacle of a complex journey, but in reality, it’s just the beginning. Once the papers are signed, there will be another culture coming into how you’re doing things. And merging these two different company cultures can be a complex task.

So, during due diligence, make sure to ask about the company’s…:

- Cultural Integration: Every company has its own culture, values and ways of doing things. When two companies merge, these cultures also have to merge. This is often easier said than done. It’s not just about integrating systems and processes, but also about aligning philosophies, work ethics and even the small day-to-day practices that define a company’s culture.

- Operational Synergy: The goal of any acquisition is to create a company that is more valuable than the sum of its parts. This often means finding synergies between the operations of the two companies. That might be consolidating departments, leveraging new distribution channels or cross-selling products to a broader customer base.

- Talent and Leadership: People are the backbone of any organization. During integration, decisions have to be made about who will stay, who will go and who will lead. These decisions are often fraught with emotion and politics, making them difficult but necessary.

- Systems and Processes: Every company has its own way of doing things, from the software it uses to the processes it follows. Integration requires a careful audit of these systems and processes, followed by a plan to bring them into alignment.

- Financial Integration: This involves merging accounting systems, financial controls and reporting structures. It’s crucial for providing a unified picture of the company’s financial health and for making informed strategic decisions.

- Legal and Compliance: Mergers and acquisitions are often complex from a legal standpoint. The integration phase requires careful attention to ensure that the new entity is in compliance with all laws and regulations, including contracts, employment laws and industry-specific regulations.

Always remember that ignoring red flags can be disastrous. For example, if the company you’re acquiring doesn’t value one-on-ones or performance reviews, that could be a sign of potential trouble ahead.

Done well, integration can lead to a stronger, more efficient and more profitable company. Done poorly, it can result in a loss of value, talent and competitive advantage.

Why Founders Should Learn How to Delegate Decisions

When acquiring a new company, it’s also crucial to keep the leaders, especially if they’re inspirational. Their presence can help retain other employees. Also, never delegate the vision of your company.

Being involved and decisive is key to successful integration.

As a founder, you can’t make all the decisions, so you need to learn to delegate – particularly when you’re merging two companies. Of course, delegation doesn’t mean abdicating responsibility. It just means trusting the people you hired to take on certain tasks so you can focus on higher-level business growth.

Or, as I say: Trust but verify, especially when it comes to new hires. 😉

Last Word on Buying a Small Business

Acquiring a business can be rewarding process, but it’s also a complex process. It certainly can be successful, but my advice (based on my own experience from buying small businesses) is to avoid buying failing businesses.

But either way, focus and due diligence are key.

One last note: Acquiring multiple companies at the same time can be overwhelming and counterproductive. Each acquisition is a full-time job in itself, requiring your undivided attention for successful integration.

Ideally, you want to buy one at a time and focus on integration.

For more insights and lessons about marketing, check out our Leveling Up podcast on YouTube.