In the world of business, it’s not just about keeping up with the Joneses, it’s about outperforming them. That being said, this year has seen some notable shifts in the way companies are adapting their operations to maintain relevancy and profitability. For some, these business trends have developed more from survival than positive growth.

In this post, we highlight some of the most prominent business trends that companies are leaning into.

5 Business Trends to Keep an Eye On

1) The Revival of the CEO: Leading from the Front

It’s fascinating to see the return of CEOs to an active role in their companies. For example, in logistics giant Flexport, one of the founders reclaimed the CEO position from Dave Clark, a former Amazon executive, after only a year of being with the company:

Why is that unique? Because it’s an example of business owners stepping back into an active role in their company to “tighten up the ship,” so to speak.

Former operators of companies are realizing how constrictive the economy is getting, and it’s prompting them to re-enter the picture to help their business ride through any sort of economic storm. It’s a perfect lesson in finding ways to cut costs, up to and including C-suite employees. And it’s happening more and more.

Stepping back into the business isn’t a glamorous move, but sometimes it’s a necessary one. Several CEOs have had to “eat glass,” metaphorically speaking, by cutting staff and going back to the operational grindstone. It’s a tough decision, but it can be crucial for refocusing the business and realigning it with its core objectives.

Tip: If you find your business drifting from its goals, don’t hesitate to take back control. Times of economic uncertainty may warrant more involvement in order to save on costs. It may be grueling to have to come out of retirement or put other projects on the back burner for a time, but it could mean the difference in saving your business versus letting it slowly decay.

2) Cutting Costs and Doubling Down

Businesses are turning towards razor-sharp focus to achieve multiple objectives. Shopify, for instance, made headlines by offloading its delivery platform, teaming up with Amazon, and concentrating on delivering an excellent e-commerce experience. This focus is not just beneficial, but also essential for two main reasons:

- Cost-Cutting: Companies are increasingly strict about eliminating unnecessary expenses enhancing operational efficiency. It’s all with the hard, focused intention of minimizing expenditures and maximizing revenue. If businesses struggle to raise revenue, then the natural recourse is to cut down on spending (including reductions in personnel).

- Zero Tolerance for BS: The tolerance level for distractions and non-core activities is nearing zero in many companies, which is especially crucial for firms aiming to hit their earnings targets. It’s largely inspired by how tight the economy is ultimately getting. When the dollar grows less valuable, people are less likely to spend, and that includes both B2B and B2C sectors, which means customer retention and deal renewals get tougher to maintain. You see where this is going.

Tip: Evaluate your business for any “fluff” that can be trimmed down or cut out completely. In what ways is your company spending money that doesn’t need to be spent? These could be non-essential activities or even company roles that no longer provide the value they once did. It could mean downsizing one or more departments of your business in pursuit of making remaining personnel more productive and efficient.

3) Seeking Profitability: No Room for Vanity Metrics

When a business is publicly traded or backed by significant funding, the spotlight is on performance metrics.

The market is interested in growth with profitability, not growth at the cost of profitability.

The pressure to deliver on earnings and revenue expectations is pushing businesses to become more streamlined and efficient.

In these scenarios, it can be tough for brands to devote funds toward innovation and creative exploration that isn’t concretely associated with revenue growth.

Tip: Publicly traded companies need to consistently show growth and profitability to maintain and grow their share prices, attracting more investors. If your brand is one of those companies, it means that you, too, have to find ways to maximize the profit margin.

4) The Interest Rate Conundrum

When interest rates are close to zero or even negative (yes, it’s a thing!), it’s like an all-you-can-eat buffet of growth opportunities. You can borrow capital cheaply to invest in research, human resources or expansion projects. That shiny new office or cutting-edge software? Yep, it’s all on the table. It’s the perfect time to be ambitious and extend your reach, either by diversifying your product range or tapping into new markets.

But businesses first need to grapple their way out of debt before doing any of those things. That means eliminating any and all debt from your business so that your profits are actually profits.

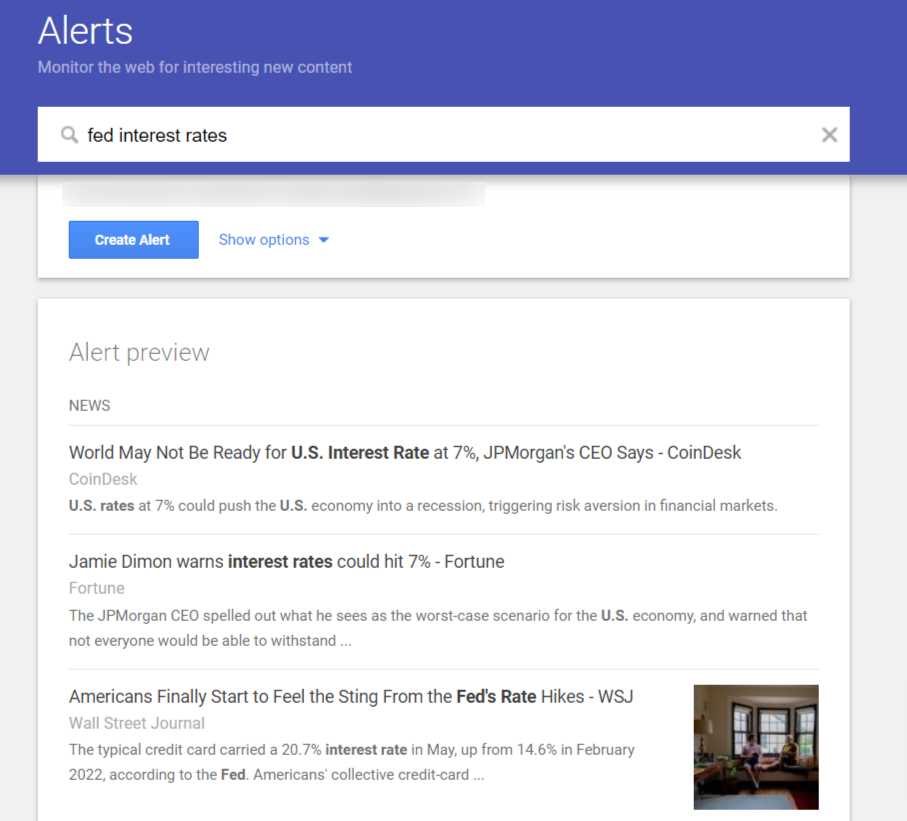

As someone at the helm, you’re the tightrope walker of your business. You’ve got to balance growth and efficiency, depending on the rhythm set by interest rates. Keep an eye on reports from the Federal Reserve or your country’s central banking institution. Subscribe to economic bulletins or create Google Alerts for interest rate news. Minimizing surprises is key here.

Tip: Keep a close eye on interest rate trends. Depending on the economic landscape, you may need to pivot your focus from growth to efficiency.

5) Playing the Long Game: Compound Focus for Lasting Success

Let’s be real for a second: We live in a world addicted to instant gratification. Whether it’s fast food, same-day delivery or skyrocketing startups, the culture of “now” pervades every aspect of our lives. So naturally, businesses feel the pressure to score quick wins — perhaps through buzzworthy marketing stunts or low-hanging product enhancements.

But is this approach built to last? Probably not.

The Principle of Compound Focus

The concept of compound focus is similar to compound interest in finance. You invest a small amount consistently in a high-quality asset and let it grow over time. The interest you earn starts to earn interest, and voila! You’re reaping exponential benefits.

Similarly, in business, committing to a narrow range of activities allows your expertise, resources and brand value to compound. The benefits may not be obvious initially, but as time goes by, your competitive edge sharpens. You become the go-to expert in your niche, and that’s an incredibly powerful position to be in.

How to Commit to Compound Focus

So, how can your business adopt a long-term growth strategy? Here are some ways to do it:

- Be ruthless in prioritization: Not all business activities are created equal. Focus on what genuinely drives value and allocate your resources there.

- Invest in talent and training: A well-skilled workforce is the lifeblood of any business. Invest in training and development programs that align with your long-term vision.

- Engage in deep work: Shallow activities may offer quick gains, but avoid the temptation. Dedicate time and effort to projects that align with your overarching vision.

- Reinvest the gains: As your expertise compounds, you’ll start seeing gains. Don’t cash out; reinvest in your business to fuel further growth.

- Measure the right metrics: Long-term focus means you might have to ignore some short-term indicators. Make sure your KPIs are aligned with your long-term vision.

Tip: Patience is indeed a virtue, especially when you’re playing the long game. A narrow, sustained focus lets you dig deep, excavate value, and build something extraordinarily robust.

Last Thoughts on Business Trends to Look Out For

The key takeaway at the end of all of this is this: Focus and efficiency are the linchpins for success right now.

While the economic climate and specific circumstances may vary, doubling down on what works and trimming the fat where needed could be your ticket to long-lasting success.

So, are you ready to turn these business trends into business truths for sustainable growth?

For more insights and lessons about marketing, check out our Marketing School podcast on YouTube.